Financial Health Optimization: All You Need to Succeed in 2023

Introduction

With political and economic crises, it is more important than ever for all companies to assess and optimize their financial health. This will prevent them from having thin margins or running low on cash. However, there is a perceived inability to control the organization’s complex processes and how they impact the financial statements.

Hence, we will discuss in this article everything about companies’ financial health and the best ways to optimize it. It will also cover financial modeling and tools to help you forecast your company’s performance and ways to improve your financial management and guarantee your business success.

Financial Health Optimization:

What is financial health optimization?

Financial optimization is the practice adopted in companies to increase revenue while minimizing costs. It uses legal and ethical methods to help them achieve higher profits in the short, medium, or long term.

Why is financial optimization important for businesses?

Financial health optimization is critical to creating effective sales and operations planning and successful integrated business planning. It also increases your capacity to generate profits and grow.

For instance, credit ratings are essential for your business. They can prevent you from being rejected when applying for a loan or having a high-interest rate on your loan.

Therefore, having a financially healthy business will help you attract lenders such as bank and positively contributes to its viability.

What are the Barriers to Effective Financial Optimization?

The most apparent barrier to effective financial optimization is the ability to perform it. And this is due to many reasons:

- Organizational silos

- The lack of a standard reporting system

- The reporting system cannot provide the needed data.

How to Determine the Financial Health of your Company?

Analyze the Balance Sheet:

The balance sheet is a statement that helps determine your company’s financial position at a specific point in time. It is like a snapshot of its assets, liabilities, and owner’s equity. This will help you understand how much debt your company has relative to equity and provide information about your company’s financial health.

Analyze the Income Statement:

The income statement provides information about your company’s financial position and performance. It is a calculation of revenue versus expenses in a specific period. It teaches us how much income is growing over specific accounting periods, which can help you learn about the company’s financial health.

Analyze the Cash Flow Statement:

The cash flow statement is the most important document to analyze the company’s finances. It serves as a source of insights into how your company used its cash during an accounting period. It provides you with information about the liquidity situation and the company’s sources of money to help you understand your company’s financial health.

Financial Ratio Analysis:

Financial ratios are potent tools to determine your company’s overall financial health. Ratios fall under various categories, like profitability, liquidity, solvency….etc. They should be compared across accounting periods and against competitors to understand whether your company is improving or declining and how well it is doing against direct and indirect competitors.

What should be done to optimize your finances?

Know your credit score:

Investors see your credit score as an indicator of the creditworthiness of your business. Therefore, it is essential to know your credit score and to take all necessary steps to improve it.

Use good financial metrics:

Financial KPIs (key performance indicators) are metrics organizations use to track, measure, and analyze a company’s financial health. They are under many categories: profitability, liquidity, efficiency, solvency, and valuation.

While you may have a financial background, a basic understanding of your financial metrics will help you improve your decision-making process, as well as your chances for improving your company’s performance.

Therefore, choosing the right financial KPIs will help you track, monitor and understand your company’s financial health. It also enables you to make the right decisions to improve it.

Learn more about KPIs and how to choose them, by reading 20 KPIs every growing business should track

Automate your processes:

Automating your bookkeeping and accounting function can help your business save time previously spent on manual and spreadsheet-based systems. Implementing an integrated cloud enterprise resource planning system will help you make a big step toward supporting your company’s sound financial health while saving time, money, and hassle.

You can read the full article to learn more about the eight financial processes to automate.

Use the right technology:

Technology is critical to improving your company’s financial health. It offers many benefits:

- Task automation: This reduces data entry time and errors.

- Easier administrative processes.

- Information standardization

- Better visibility and control over your cash flow

Moreover, the right technology helps you manage business processes, billing, analytics, and more. This gives you a holistic view of your business, a deeper understanding of your numbers, and know the exact steps to improve your business’s financial health.

Financial Modeling

What is financial modeling?

Financial modeling is the process of evaluating the financial performance of a company. It combines accounting, finance, and business metrics to create accurate financial forecasting for the business. Financial modeling considers all relevant factors, growth and risk assumptions, and their impact on the industry. This can affect future events and decisions. Companies of all sizes can use financial modeling and projection to thrive and grow.

What is it used for?

A financial model is helpful for your company’s executives and decision-makers. It is often used to analyze and predict how future circumstances or executive decisions could influence a company’s stock performance.

A financial model can help you:

- Make business decisions.

- Make investments in private/public companies.

- Value pricing security (in case of raising money, issuing shares/debts)

- Undergo a corporate transaction, such as a merger or acquisition.

What are the types of financial models?

There are several types of financial models.

-

Three-statement model:

It is the most important model. It considers the three primary financial statements: income statement, balance sheet, and cash flow statement.

-

Sensitivity analysis (What-If Analysis):

It shows the effects of changes in assumptions. It changes one variable at a time and then demonstrates the impact of that change.

-

Scenario Analysis:

Very similar to sensitivity analysis but involves changing all or many variables simultaneously rather than one at a time.

-

Strategic forecast model:

It assesses the long-term effect of some initiatives they are considering.

-

Discounted Cash Flow Analysis:

It uses the expected future cash flow value to estimate the net present value of an investment.

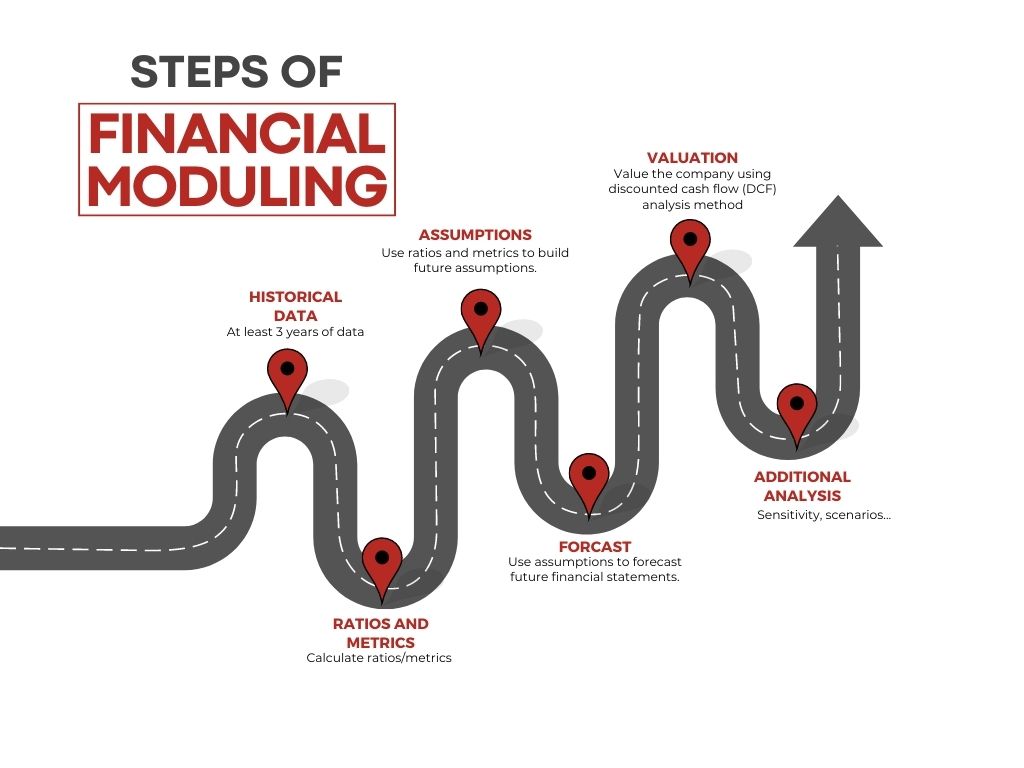

How to create a financial model?

A successful financial model must be simple enough for everyone to understand and detailed enough to handle complex situations and transactions.

To learn more about financial modeling and projection or a step-by-step guide with illustrations to help you start with famous models, you can check “A Practical Guide to Financial Modeling and Projections for Growing Businesses.”

How to get more accessible and more accurate financial projections?

Whatever your business’s size or industry, you can use financial projections and modeling to grow and thrive your company. Although much of it is considered essential work and can be done in spreadsheet applications, more innovative tools are now accessible for smaller companies and can help them have more detailed and accurate financial modeling and projections.

All-in-one Solution:

How Will NetSuite Help You Optimize Your Business' Financial Health

Businesses need magic software to help them achieve their goals in creating a successful business plan.

An Association for Financial Professionals survey claims that “FP&A teams spend 75 percent of their time gathering data and administering processes”.

Therefore, to reduce the time and resources spent on repetitive administrative processes, every company needs capable financial software to gather data in one place, automate essential operations, and save time.

It is the number 1 financial management solution worldwide. It ensures real-time visibility. It reduces budgeting and forecasting cycle times and accelerates financial close.

NetSuite Financial Management integrates with additional business applications — including order management, inventory, CRM, and commerce — so you can run your entire business with a single solution. You are leading to efficient management of your financial processes and driving your business strategy and growth.

NetSuite Planning and Budgeting:

NetSuite Planning and Budgeting automates effortful planning and budgeting processes, saving much time for the finance team. It collaboratively produces budget forecasts, reports, financial position reports, and what-if scenarios. It has a prebuilt industry-specific statistical model that includes revenue and expense modeling. Moreover, NetSuite is a scalable solution that can grow with your business and address its new needs.

NetSuite budgeting and reporting gives you more control and improve your visibility. It also automates the financial process, saving finance staff time, relocating their time from data entry to strategic analysis activity, and improving the company’s financial position.

Conclusion

Using the tools and strategies explained in this article, all business owners can rest easy because they now have a finger on their company’s financial health. This will allow them to focus on more critical tasks, like improving their customer experience, implementing growth strategies, and planning for future projects.

Contact our expert team today to learn more or if you want free consultancy.