Choosing the Right Financial Software: A Comprehensive Guide for Businesses of All Sizes

Introduction

Managing finances can be challenging, especially when dealing with large volumes of transactions, complex accounting rules, and ever-changing regulations. Financial software has become essential for businesses of all sizes to manage their financial operations effectively. However, choosing the right one can be overwhelming with so many financial software options available in the market. This article will discuss how to choose between different financial software and provide an overview of the most popular ones. It will also highlight the main features to look for when choosing software.

Why is financial software essential?

Financial software is essential for businesses of all sizes, enabling them to manage their financial operations effectively and efficiently. Whether you run a small start-up or a large corporation, financial software can help you streamline your accounting and bookkeeping tasks and monitor your cash flow. It also helps executives to bridge the gap between managerial and financial accounting.

- It helps you keep track of your business’ income and expenses.

- It can record and categorize financial transactions in real-time

- Generate accurate financial reports and gain a clear understanding of your business’s financial health.

- Easily identify areas where you may need to spend more or generate more revenue and adjust accordingly.

- It automates many time-consuming tasks, such as invoicing, payroll, and tax calculations. This saves you valuable time and reduces the risk of errors occurring when these tasks are performed manually.

- It helps you make more informed financial decisions by providing valuable insights into their financial performance, analyzing financial data, and generating reports; you can identify trends and patterns that can inform your decision-making process.

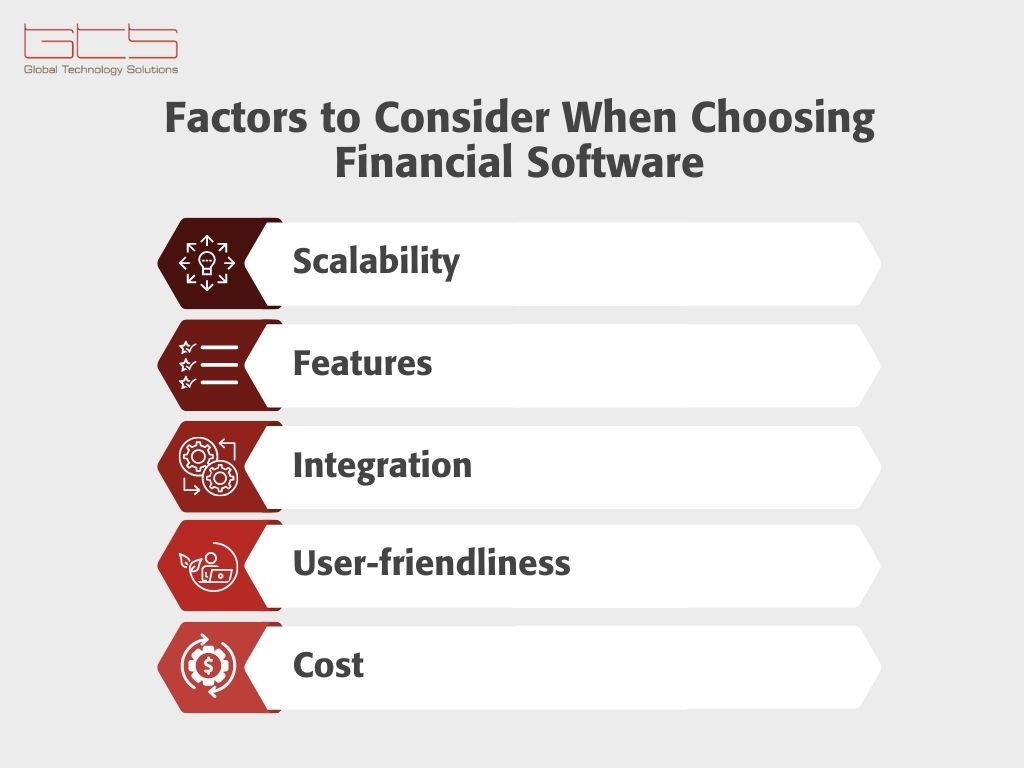

What Are the Factors to Consider When Choosing Financial Software?

Choosing the right financial software is key to ensuring your business’s success and guaranteeing a return on your investment. Here are the main features to look for when choosing the right software.

Scalability:

When choosing financial software, it’s essential to consider the scalability of the software. You want software that can grow with your business and handle increasing volumes of transactions.

Features:

Different financial software comes with varying features. Evaluating your business needs and choosing software that meets your needs is essential. Some features to look out for include invoicing, accounts payable, accounts receivable, budgeting, and forecasting.

Integration:

Your financial software should be able to integrate with other business systems, such as customer relationship management (CRM), inventory management, and payroll systems.

User-friendliness:

The software should be easy to use and navigate, even for non-accountants. It should have a straightforward user interface and provide adequate training and support resources.

Cost:

Financial software can be costly, and choosing software that fits your budget is essential. If applicable, you should consider the upfront cost, ongoing maintenance (like servers or others), and the IT and support fees.

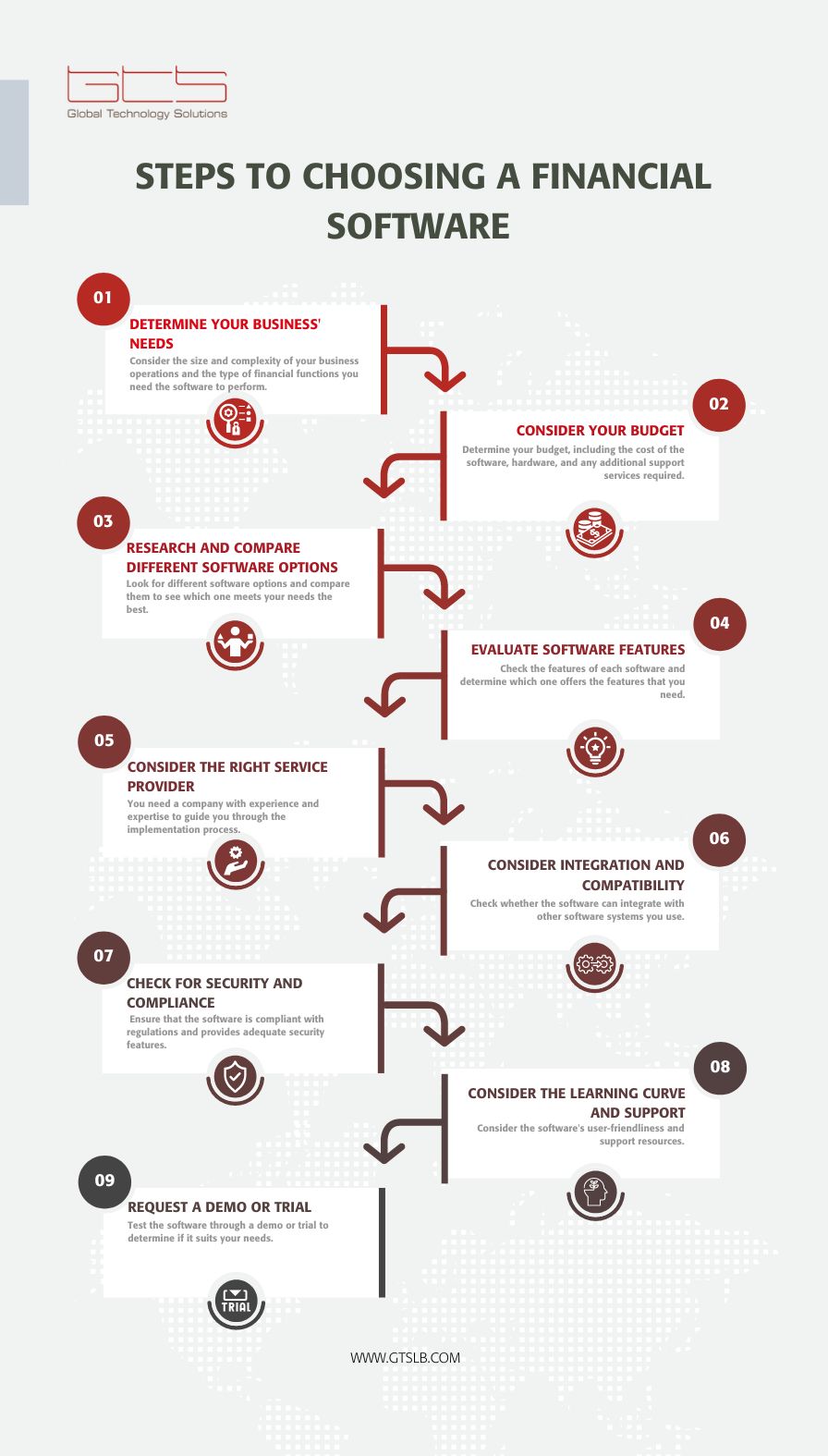

What are the steps to choosing financial software?

Choosing the right financial software for your company is an important decision that can significantly impact the efficiency and accuracy of your financial operations. With so many available options, choosing the best financial software that suits your business needs can be overwhelming. Here are the main steps to selecting the right software.

1. Identify your business needs

Before choosing financial software, it is essential to identify your business needs. Consider the size and complexity of your business operations and the type of financial functions you need the software to perform. Every organization has its unique needs or requires accounts for multiple users.

2. Identify your budget:

The price of the software may not be the only thing you have to pay for. Therefore, you should determine your budget while considering the cost of the software, hardware, and any additional support services required.

3. Research and compare different software options

Once you have identified your business needs and budget, research and compare different financial software options. Read reviews, ask for referrals from other businesses, and seek the advice of experts to narrow down your options. Look for software that meets your requirements and falls within your budget.

4. Evaluate software features

Evaluate the features of each financial software option on your shortlist. Look for software with the features you need to perform your financial operations efficiently. For example, if you need to manage invoices and billing, look for software with robust invoicing and billing features.

5. Consider the right service provider

Choosing the service provider is a crucial step in the process. You need a company with experience and expertise to guide you through the implementation process. This will help you choose the right feature and train your team to start having a return on your investment. You can learn more about Global Technology Solutions’ experience.

6. Consider integration and compatibility

When choosing financial software, it is essential to consider integration and compatibility with your existing software systems. Look for software that can integrate with other software programs, such as your accounting software, to streamline your financial operations.

7. Check for security and compliance

Security and compliance are essential factors to consider when choosing financial software. Look for software that is compliant with relevant regulations and provides robust security features to protect your financial data.

8. Consider the learning curve and support

Consider the learning curve and support provided by the software vendor. Look for user-friendly software that offers support resources, such as tutorials and customer service, to help you get the most out of the software.

9. Request a demo or trial

Finally, before making a final decision, request a demo or trial of the software to test its functionality and ease of use. This will allow you to see how the software works in practice and determine if it fits your business correctly.

What Are the Most Popular Financial Software Options

QuickBooks:

QuickBooks is one of the most popular accounting software in the market, with over 7 million users worldwide. It’s user-friendly and offers to invoice, expense tracking, payroll processing, and inventory management features. QuickBooks comes in various versions, including desktop and online, with varying features and pricing. However, it has limited scalability and customization options. Its reporting and analytics capabilities are a bit primitive.

Xero:

Xero is cloud-based accounting software that’s popular among small businesses. It offers invoicing, expense tracking, inventory management, and payroll processing features. Xero also has a user-friendly interface and integrates with over 800 third-party applications. However, scalability and customization options are limited. The reporting and analysis features are somewhat primitive.

Sage 50cloud:

Sage 50cloud (formerly Sage Peachtree) is a desktop-based accounting software popular among small and medium-sized businesses. It offers invoicing, expense tracking, inventory management, and payroll processing features. Sage 50cloud also provides excellent security features, such as multi-user access controls and data encryption. The reporting and analysis functions are rudimentary. However, the scalability and customization options are not optimal.

NetSuite Financial Management:

NetSuite is the world’s #1 cloud financial management software. Its specificity is that it combines traditional accounting practices with the latest technology.

According to Forbs, “Use NetSuite when you need a comprehensive business management solution that can cover all areas of your business.”

NetSuite Financial Management is a cloud-based financial software that has thousands of users all around the world. Business owners and financial managers like NetSuite financial management because it is a user-friendly platform that helps increase their financial visibility. It offers various features, including general ledger, accounts payable, accounts receivable, fixed assets, and cash management. NetSuite Financial Management also provides advanced financial reporting and analytics capabilities, integrating with other business systems such as CRM and inventory management.

Why do business owners and financial managers like NetSuite Financial Management?

NetSuite Financial Management offers several benefits that distinguish it from other financial software options. These benefits include:

Excellent report generation:

NetSuite can generate automated reports with a detailed analysis of all your financial data. It also provides finance and accounting teams with excellent data analysis tools. Prebuild financial reports are tailored to highlight specific results depending on the business needs. It is very flexible, and reports are fully customizable.

As a result, you can quickly identify trends as they develop to help you take the right action on time using real-time data.

Complete financial visibility:

The main thread to financial visibility is fragmented data. It is mainly due to storing your data in different places, creating technology silos, and data scattering. Having all your data stored on the cloud in NetSuite enables you to get real-time data and improves your financial visibility.

Click to learn more about the 4 major financial visibility challenges and how to overcome them.

Lower cost of ownership:

As NetSuite is a SaaS (software-as-a-service) solution, all the data will be stored on the cloud.

The big benefit of SaaS cloud software is that you don’t have to take on the infrastructure costs. As the total cost of ownership (TCO) counts about 11% of the total cost of on-premises software, for NetSuite, hardware, system software, and ongoing maintenance are all included in your subscription.

Scalable:

As your business grows, you need software that can handle the added demand requirement to help you get optimal performance.

With a cloud-based technology solution like NetSuite, you can readily stipulate specific service characteristics that identify usage parameters within the account (monthly transaction volumes, number of users, file storage…etc)

Conclusion

Choosing the right financial software for your business can be a challenging task. While many financial software options are available, each with its strengths and weaknesses, choosing software that meets your business needs is important. Still, you can make an informed decision by considering scalability, features, integration, user-friendliness, and cost.

You also need an experienced service provider to ensure the proper implementation of the features adapted to your business’s needs, which will help your company succeed and improve your profits.

Global Technology Solutions has more than 18 years of experience in developing, implementing, and training employees to use financial software in the MENA region. You can contact us if you need help or get a free consultation.

Eager to discover how the #1 cloud ERP can transform your business

Request your demonstration by submitting the form below:

You can check our privacy policy here